NOTE: I am doing this specifically with the TESLA stock because I (and many other people) believe that it will hit $1,500 to $2,000 per share in a year or two. I would not take this type of crazy risk with just any stock. Also, I am doing this with a separate experimental account. This money is separate and not connected to my other investments.

This is not for everyone…but here it goes.

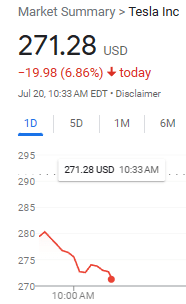

Tesla hit a high of $298 per share yesterday (July 19)….

And today (because of bad news) it has dropped down to $273…and it may go lower.

HERE IS WHAT I AM THINKING: I am thinking of making a quick $25 per share here ($298-$273 = $25; a little more when it hits $300 per share) because I am confident that it will go back up to $300 – soon. When the stock was around $280 (and I was expecting it to keep dropping) I placed a limit order for $275. LIMIT means that the purchase will only go through when the stock hits $275. I was only going to do this once – but then I noticed that the price kept dropping. So I placed another limit order for a second share for $272.

=======================================

10:34am UPDATE: My order went through because the price kept dropping….right now it’s at $271.

Bottom Line: I purchased two shares of Tesla; one for $275 and a second one for $272 because I am expecting the price to go back up to $300 per shares soon (by the way, I buy my shares through Fidelity).

Technically, I would show a profit once the stock goes up to at least $276 per share. This may not seem like a big deal ($1 profit) – but this has to be multiplied by the numbers of shares purchased. For example, if I purchased 1000 shares, a $1 move up in price means an additional $1000 in my pocket.

==================================

SUMMARY:

SPENT: $547 ($275 + $272)

Once the stock goes up to $300, the shares will be worth $600. My profit (if I sell the two shares) will be $53.

$600 – $547 = $53 Profit

I have other shares that I intend to hold for the long term. However, with this particular account I am looking for quick profits.